Maine Township is Being Reassessed, Deadline to Appeal is July 18, 2025

O'Connor discusses how Maine Township is being reassessed and the deadline to appeal is July 18, 2025.

CHICAGO, IL, UNITED STATES, July 11, 2025 /EINPresswire.com/ -- The Cook County triennial reassessment is affecting the north and northwest with high assessments. Property owners all around the Chicago area wait to see how high their property values and taxes will go up under the Cook County Assessor’s Office (CCAO). Many taxpayers were hit with high values as CCAO has handed out tax bills that were sometimes 700% higher or more than they were just three years ago.Maine Township is the latest to be affected by the reassessment, and while the values are not as high as the values in 2023, it is still seeing value spikes of up to 41%. Chicagoans have the right to protest these values and are actively encouraged to do so by the lead Cook County Assessor. But, the people of Maine Township only have until July 18, 2025, to file their informal appeal, while Board of Review (BOR) appeals are set for a later date. O’Connor will show what the new numbers are and why every citizen should protest their taxes.

A Tale of Reassessment and Rising Taxes

Illinois already has the second-highest property taxes in the United States, but Cook County is another ordeal onto itself. Illinois has unique tax rules, the equalization factor, and hundreds of government entities. This is driven into overdrive in Cook County, where large city pensions must also be paid. Then there are concerns involving assessments being intentionally inaccurate or businesses getting tax cuts only to have them passed onto working people. This is only compounded by the triennial reassessment, which dumps massive value changes on people every three years.

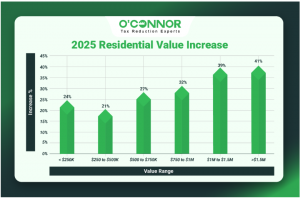

Maine Reassessment Hands Homes 25% Increase in Taxable Value

According to CCAO, the total market value of residential property in Maine Township was $15.65 billion in 2024. This number was obliterated in 2025 thanks to reassessment, where it was increased by 25%, coming to a new overall value of $19.60 billion. It should be noted that this is just the base assessed value of a property, not counting the tax rate which will be put on top of it. This represents a large bump in the biggest expense the average Chicago homeowner has.

The largest pool of residential value in Main Township is reserved in homes valued between $250,000 and $500,000, which increased by 21% to $9.63 billion in 2025. The second-largest collection of value came from homes worth between $500,000 and $750,000. These homes experienced a staggering increase of 27%. Homes worth under $250,000 were next in value. These homes were handed an increase of 24%. These three categories represent the people that can least afford such large jumps in the tax bills. Traditionally, it is these three groups, especially those under $250,000, that have been victims of gentrification.

It was not only working families or middle-class homes that were affected. The most expensive residences in Maine township got hammered by a spike of 41%. While these homes, each worth over $1.5 million, only make up a fraction of the value, this was still a hard blow. Homes worth between $1 million and $1.5 million fared a bit better but still got slammed with an increase of 39%.

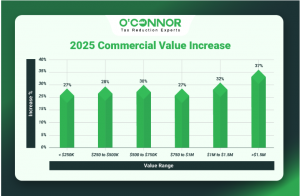

Maine Township Commercial Property Surges 36%

Stampeding prices and gentrification do not only impact homes. Historically, some of the largest victims of this phenomenon are businesses in transitioning areas. This seems to be the case for commercial properties of various sizes in Maine Township as the total property value skyrocketed by 36%, an increase of $1.15 billion. Such rises can harm communities, as businesses might be forced to close or jack up their prices. Apartments are also classified as commercial properties, which means higher rents.

It was businesses and commercial properties worth over $1.5 million that felt these changes the most. Properties in this price range saw an increase of 36%, which drove them from a 2024 total value of $2.68 billion to $3.67 billion. As these big businesses make up the majority of the total value, this brought the average increase across the township up with them. Commercial property tends to work in the opposite direction of residential, with the most expensive properties dominating the value percentage. Maine Township is no exception. Being larger businesses does not protect these properties from being greatly affected by these value hikes, and it can have knock-on effects for both the owners, investors, and customers.

Even the smallest businesses were not spared, as those worth under $250,000 saw an increase of 27%. Medium-sized businesses worth between $1 million and $1.5 million perhaps got it the worst, seeing an increase of 32%, a total gain of $55.71 million.

Appeals are the Only Solution

After the abysmal 2023 reassessment that saw taxes go up in some places by 700%, a “circuit breaker” policy was proposed by the chief Cook County Appraiser himself. This is currently stalled, as are several other schemes to put things right. Currently, the only option for those in Cook County that want relief is to pursue a property tax appeal.

The people of Cook County have unique challenges and advantages when it comes to appeals. While recent investigations discovered that appeals vastly prefer to help commercial interests over residential ones, there is still plenty of opportunity to score a value reduction. Many inside CCAO encourage appeals by everyone, and the BOR routinely sides with taxpayers over CCAO.

While there is a deadline for appeals in Maine Township set for July 18, 2025, this is for informal appeals only. These can be very important and should always be explored first, but formal BOR appeals can also be used. The main advantage of being in Cook County is that BOR appeals and informal appeals have different deadlines, unlike the rest of Illinois where they are one-and-the-same. If the informal deadline is missed, then the BOR is still a good candidate. The BOR will meet later in the year, so if the informal deadline is missed, a taxpayer will have to wait, but this is still better than the alternative.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.