Frozen Food Industry Sector Explosion: Growth Drivers & Profitable Segments Revealed

Frozen Food Boom 2025-2032: Surprising Drivers Behind Skyrocketing $651.10B Market

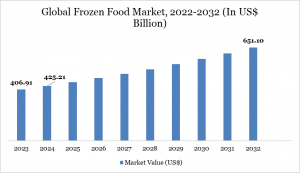

Frozen Food Market in the USA set to surge from $425.21B in 2024 to $651.10B by 2032, driven by rising convenience demand, retail growth, and changing lifestyles.”

AUSTIN, CA, UNITED STATES, September 29, 2025 /EINPresswire.com/ -- Market Size and Growth— DataM Intelligence 4Market Research LLP

The global frozen food market was approximately US$425.21 billion in 2024 and is expected to reach US$651.10 billion in 2032, growing at a CAGR of about 5.6% during the forecast period (2025-2032).

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/frozen-food-market

The fast-paced lifestyle of urban consumers has driven strong demand for convenient meal options, with frozen foods emerging as an ideal solution due to their long shelf life and preserved taste. Surveys highlight that 72% of consumers have consistently purchased or increased their consumption of ready-to-eat meals, including meal kits, grab-and-go, and takeout options. Digital ordering platforms reflect this trend, with DoorDash recording 532 billion orders in Q2 2023 and a 26% increase in gross order value to US$16.5 billion. Additionally, deli-prepared foods and meals saw total dollar sales of US$24.5 billion in the 52 weeks ending July 2023, marking a 6.7% year-over-year rise.

Health consciousness is further shaping consumer preferences, leading to increased demand for plant-based, organic, vegan, gluten-free, and low-calorie frozen foods. Product innovation is driving market growth, as brands focus on convenience combined with enhanced nutritional value. For example, in June 2025, Nissin Foods launched Kanzen Meal, its first single-serve frozen food line targeting health-conscious consumers and GLP-1 weight loss drug users. The meals emphasise high nutrient content in smaller portions, catering to modern lifestyle trends and the need for satisfying, nutrient-dense options.

Growth Driver: Increasingly Diverse Flavours Continue to Grow in the Frozen Aisle

The increasing availability of diverse and international flavours in the frozen food aisle is driving market growth by appealing to evolving consumer tastes. Millennials and Gen Z, in particular, are seeking unique, global, and gourmet options that deliver restaurant-quality experiences at home. Sales data shows that global street food reached over US$543 billion in 2022, and younger consumers are 24% more likely to try globally inspired frozen products. Brands like Trader Joe’s in the US and ITC Master Chef in India are offering meals that blend ethnic and local flavours, while European markets see rising demand for gourmet options such as truffle pasta and seafood paella.

Innovation in product offerings and packaging is further enhancing the appeal of frozen foods. In 2024–2025, companies like Baja Foods and Authentic Asia launched premium and single-serve lines with high-quality ingredients and convenient, takeout-style designs. Baja Foods’ Chef Gustavo Chicken & Cheese Enchiladas feature antibiotic-free chicken, fresh vegetables, and fiesta rice, while Authentic Asia’s meals use separate cooking trays to preserve authentic taste and texture. By expanding flavor diversity and delivering convenient, high-quality dining experiences, manufacturers are transforming frozen foods into exciting culinary options, attracting new customers and driving sustained market growth.

Consumer Analysis:

• Consumer behaviour in the global frozen food market is largely driven by convenience and time-saving needs, with households preferring products that are quick and easy to prepare without compromising quality.

• Traditional vegetables lead purchases, with 69% of households buying individual vegetables, 64% mixed vegetables, and 63% potato-based items, highlighting strong demand for staple frozen foods.

• Frozen fruits also show notable demand, with mixed fruits purchased by 53% of households and individual fruits by 44%, reflecting growing interest in healthy and convenient snack options.

• Prepared vegetables and vegetable-based entrées are bought by 43% and 41% of consumers, indicating a moderate shift toward ready-to-eat and semi-processed frozen foods.

• Lower adoption of riced or spiralized vegetables, smoothie mixes, and yogurt/fruit bites, ranging from 30% to 22%, suggests opportunities for innovation in convenience-focused segments, as providers tailor offerings to meet evolving health and taste preferences.

Segment Growth: Fruits And Vegetables Hold the Highest Share In the Frozen Food Market Due To Their Convenience, Year-Round Availability, And Preserved Nutritional Value

Fruits and vegetables hold a significant share in the global frozen food market due to their convenience, long shelf life, and nutrient retention. Growing demand for healthy, ready-to-eat options has driven consumers toward frozen produce, which remains available year-round regardless of seasonality. Freezing technology preserves freshness, taste, and nutritional value, making frozen options preferred over canned alternatives. Rising health consciousness and busy lifestyles have further increased the consumption of frozen fruits for smoothies and breakfast meals, while frozen vegetables are widely used in home cooking and food service.

High household penetration underscores strong demand, with 94% of American households and 83% of French households purchasing frozen fruits and vegetables. Consumers favor staples like peas, spinach, courgettes, broccoli, and vegetable mixes, and there is notable growth in purchases of distributor or private-label brands. The food service industry also relies heavily on frozen produce for consistent supply, cost efficiency, and year-round availability, while product lines like Green Giant’s Restaurant Style expand retail appeal.

Technological advancements, including IQF (Individual Quick Freezing) and industrial cutting machines, have improved quality, texture, and operational efficiency, allowing manufacturers to meet rising consumer demand. Brands like Nortera’s Arctic Gardens and Del Monte’s frozen British Strawberries demonstrate how innovations preserve taste, colour, and nutrients while providing convenience. These product launches, combined with advanced freezing and processing techniques, continue to drive growth in the global frozen fruits and vegetables market.

Buy Now & Unlock 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=frozen-food-market

Regional Growth: North America Holds a Significant Share in the Frozen Food Market Due To High Consumer Adoption and Demand for Convenient, Ready-To-Eat Products

The North American frozen food market is steadily expanding, driven by shifting consumer lifestyles, technological advancements, and evolving retail strategies. Millennials, working professionals, and expatriate communities are increasingly seeking convenient, high-quality meal options. The growing demand for ready-to-eat (RTE) and ready-to-cook (RTC) meals is fueled by busy schedules, while subscription-based services like Daily Harvest, Freshly, and Mosaic Foods offer personalised frozen meal plans to suit dietary preferences.

Frozen food consumption is widely accepted across households, with 98.4% of Americans purchasing frozen items at least once a year, according to AFFI. Brands and retailers are emphasising the nutritional benefits of frozen fruits, vegetables, and seafood, which often retain more nutrients than fresh alternatives. For example, in June 2025, Conagra Brands launched over 50 new frozen products, including single-serve and multi-serve meals, vegetable sides, and gluten-free and plant-based options, reflecting the market’s focus on convenience, variety, and health.

Competitive Landscape

The global frozen food market is highly dynamic, offering significant growth opportunities for innovative brands that focus on quality and health-conscious products. Strong brand presence continues to drive market share in the B2B frozen food sector.

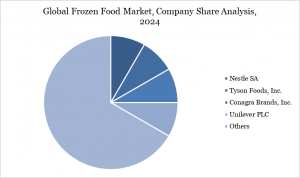

In 2024, the top five companies accounted for 13.28% of the total global market, indicating a fragmented market with substantial opportunities for smaller players.

Nestlé S.A. led the market with a 5.23% share, followed by Conagra Brands (2.87%), Tyson Foods (2.21%), The Kraft Heinz Company (1.76%), and Nomad Foods (1.21%).

The remaining 86.72% of the market is held by other players, highlighting the competitive nature of the industry and potential for new entrants to capture niche segments.

Get Customization in the report as per your requirements:- https://www.datamintelligence.com/customize/frozen-food-market

Key Developments

• In March 2024, Nestlé's Maggi brand expanded into the frozen foods market in India by introducing a new line of products under the 'Nutri-Licious' banner. This range includes Veggie Kebabs, Achari Pockets, and Special Veggie Pops, marking Maggi's second major diversification beyond its traditional instant noodles.

• In October 2024, Central Foods partnered with Tyson Foods’ UK division to expand the distribution of Tyson’s frozen food products to independent wholesalers across the U.K. This collaboration aims to enhance Tyson’s reach in the market by leveraging Central Foods' established distribution network, making its frozen poultry and other food products more accessible to independent foodservice operators. The partnership is expected to strengthen Tyson’s presence in the U.K. while providing wholesalers with a wider range of high-quality frozen food options.

• In October 2024, Delimex, a brand under The Kraft Heinz Company, has expanded its product line beyond taquitos by introducing new Crispy Quesadillas, marking its first major product launch in over five years. Available in Char-Grilled Chicken and Chipotle Chicken flavours, these quesadillas utilise The Kraft Heinz Company's proprietary 360CRISP technology to deliver a pan-fried crispiness straight from the microwave.

Why Choose This Global Frozen Foods Market Report?

• Latest Data & Forecasts: In-depth, up-to-date analysis through 2032

• Regulatory Intelligence: Actionable insights on key policies

• Competitive Benchmarking: Evaluate strategies of major and emerging players

• Emerging Market Coverage: Special focus on North America, Europe and high-growth APAC economies.

• Actionable Strategies: Identify opportunities, mitigate risk, and maximise ROI

• Expert Analysis: Research led by industry specialists with proven track records

Empower your business to stay ahead of regulatory shifts, market disruption, and climate-driven trends. Request your sample or full report today.

Related Reports

Frozen Meat Market

Frozen Vegetables Market

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.