Food Cans (Except Beverage Cans) Market In 2029

The Business Research Company’s Food Cans (Except Beverage Cans) Global Market Report 2025 - Market Size, Trends, And Global Forecast 2025-2034

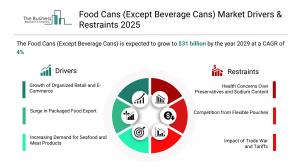

LONDON, GREATER LONDON, UNITED KINGDOM, December 31, 2025 /EINPresswire.com/ -- Food Cans (Except Beverage Cans) Market to Surpass $31 billion in 2029. In comparison, the Metal Can, Box, And Other Metal Container (Light Gauge) market, which is considered as its parent market, is expected to be approximately $161 billion by 2029, with Food Cans (Except Beverage Cans) to represent around 19% of the parent market. Within the broader Metal And Mineral industry, which is expected to be $9,511 billion by 2029, the Food Cans (Except Beverage Cans) market is estimated to account for nearly 0.3% of the total market value.

Which Will Be the Biggest Region in the Food Cans (Except Beverage Cans) Market in 2029

North America will be the largest region in the food cans (except beverage cans) market in 2029, valued at $10,068 million. The market is expected to grow from $8,771 million in 2024 at a compound annual growth rate (CAGR) of 3%. The steady growth can be attributed to the increasing demand for seafood and meat products and a significant working population.

Which Will Be The Largest Country In The Global Food Cans (Except Beverage Cans) Market In 2029?

The USA will be the largest country in the food cans (except beverage cans) market in 2029, valued at $8,864 million. The market is expected to grow from $7,686 million in 2024 at a compound annual growth rate (CAGR) of 3%. The steady growth can be attributed to the increasing demand for seafood and meat products and growth of organized retail and e-commerce.

Request a free sample of the Food Cans (Except Beverage Cans) Market report

https://www.thebusinessresearchcompany.com/sample_request?id=28425&type=smp

What will be Largest Segment in the Food Cans (Except Beverage Cans) Market in 2029?

The food cans (except beverage cans) market is segmented by material into aluminium cans, steel or tin cans and other materials. The steel or tin cans market will be the largest segment of the food cans (except beverage cans) market segmented by material, accounting for 63% or $19,675 million of the total in 2029. The steel or tin cans market will be supported by their exceptional strength and durability for bulk and long-term food storage, effective barrier properties that protect against contamination and spoilage, widespread use in thermal processing such as retort and pressure cooking, cost-effectiveness for high-volume food packaging like vegetables, meats and soups and extensive recycling infrastructure supporting steel recovery and reuse globally.

The food cans (except beverage cans) market is segmented by product into 2-piece cans, 3-piece cans and composite cans. The 2-piece cans market will be the largest segment of the food cans (except beverage cans) market segmented by product, accounting for 50% or $15,394 million of the total in 2029. The 2-piece cans market will be supported by their seamless body design that enhances structural integrity and leak resistance, suitability for high-speed production and automated filling lines, reduced material usage compared to 3-piece cans leading to cost efficiency, excellent compatibility with vacuum and retort processing for shelf-stable foods and growing demand in single-serve and portion-controlled packaging for convenience-focused consumers.

The food cans (except beverage cans) market is segmented by end use into meat, poultry and seafood, pet food, bakery and confectionery, sauces, jams and pickles, fruits and vegetables and other end uses. The fruits and vegetables market will be the largest segment of the food cans (except beverage cans) market segmented by end use, accounting for 27% or $8,489 million of the total in 2029. The fruits and vegetables market will be supported by the need for year-round availability of seasonal produce through long-shelf-life packaging, effective preservation of texture, color and nutrients during thermal processing, widespread use of cans for products like tomatoes, peas, corn and fruit cocktail, increasing demand for ready-to-eat and convenience foods in urban markets and the recyclability and durability of metal cans supporting sustainable packaging goals and export logistics.

The food cans (except beverage cans) market is segmented by capacity into less than 200 ml, 200–499 ml, 500–999 ml (0.5L–1L) and 1,000 ml and above. The 200–499 ml market will be the largest segment of the food cans (except beverage cans) market segmented by capacity, accounting for 38% or $ 11,778 million of the total in 2029. The 200–499 ml market will be supported by its widespread use for household-sized portions of vegetables, fruits, soups, sauces and ready meals, strong consumer preference for medium-sized packaging balancing convenience and value, compatibility with both manual and automated can openers and retort processing, suitability for daily-use pantry items across global cuisines and growing adoption in urban retail and e-commerce channels due to its easy stack ability and storage efficiency.

What is the expected CAGR for the Food Cans (Except Beverage Cans) Market leading up to 2029?

The expected CAGR for the food cans (except beverage cans) market leading up to 2029 is 4%.

What Will Be The Growth Driving Factors In The Global Food Cans (Except Beverage Cans) Market In The Forecast Period?

The rapid growth of the global food cans (except beverage cans) market leading up to 2029 will be driven by the following key factors that are expected to reshape food packaging, supply chains, and manufacturing processes worldwide.

Growth Of Organized Retail And E-Commerce - The growth of organized retail and e-commerce will become a key driver of growth in the food cans (except beverage cans) market by 2029. Organized retail chains and online platforms offer structured shelf space, better product categorization, and greater promotional opportunities, making it easier for consumers to discover and purchase canned food items. These modern distribution channels also support bulk purchasing and a wide range of product offerings, encouraging manufacturers to invest more in canned packaging. E-commerce, in particular, enables direct-to-consumer delivery of canned goods, which are ideal for shipping due to their long shelf life, durability, and resistance to damage. As both retail formats grow, especially in developing regions, they create a strong distribution backbone for food cans, helping to boost market penetration and sales volume significantly. As a result, the growth of organized retail and e-commerce is anticipated to contributing to a 1.5% annual growth in the market.

Surge In Packaged Food Export - The surge in packaged food export will emerge as a major factor driving the expansion of the market by 2029. As countries increasingly export processed and packaged food to meet rising global demand, especially for items like fruits, vegetables, seafood, and ready meals, the need for robust, secure, and regulation-compliant packaging like cans significantly increases, thereby driving the growth of the food cans (except beverage cans) market. Consequently, the surge in packaged food export is projected to contributing to a 1.0% annual growth in the market.

Increasing Demand For Seafood And Meat Products - The increasing demand for seafood and meat products will serve as a key growth catalyst for the market by 2029. As the global appetite for protein continues to grow, particularly among busy households and working professionals, the demand for canned formats of these products rises, directly supporting the expansion of the food cans (except beverage cans) market. Therefore, this increasing demand for seafood and meat products is projected to supporting to a 0.8% annual growth in the market.

Increase In Working Population - The increase in working population will become a significant driver contributing to the growth of the market by 2029. With more individuals engaged in full-time employment, especially in urban areas, there is less time available for cooking elaborate meals, leading to a rising preference for ready-to-eat or easy-to-prepare canned foods. Food cans offer a practical solution, as they provide quick access to a wide variety of preserved meals and ingredients with minimal preparation. Additionally, the long shelf life and portability of canned foods make them suitable for office lunches, quick dinners, or emergency meals, aligning well with the needs of time-constrained workers. Consequently, the increase in working population is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Food Cans (Except Beverage Cans) Market report here:

https://www.thebusinessresearchcompany.com/report/food-cans-except-beverage-cans-market

What Are The Key Growth Opportunities In The Food Cans (Except Beverage Cans) Market in 2029?

The most significant growth opportunities are anticipated in the steel and tin food cans (except beverage cans) market, the 2-piece food cans market, the 200–499 ml processed food cans market, and the pet nutrition food cans market. Collectively, these segments are projected to contribute over $9 billion in market value by 2029, driven by rising demand for durable, tamper-resistant packaging, expanding consumption of ready-to-eat and processed food products, and the rapid premiumization of pet nutrition categories. This surge reflects the accelerating shift toward sustainable metal packaging solutions that offer longer shelf life, high recyclability, and superior product protection, fuelling transformative growth within the broader global food cans industry.

The steel and tin food cans (except beverage cans) market is projected to grow by $2,895 million, the 2-piece food cans market by $2,385 million, the 200–499 ml processed food cans market by $2,135 million, and the pet nutrition cans market by $ 1,851 million over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.